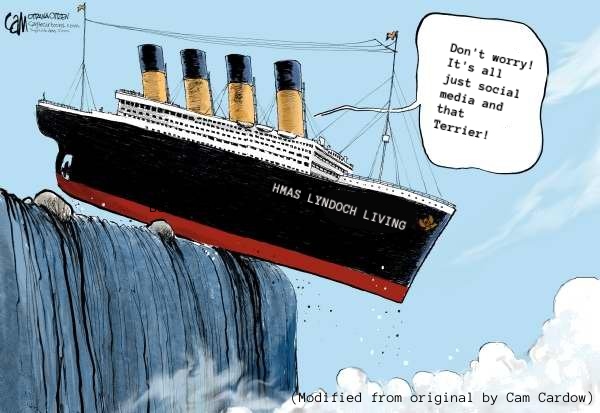

Carol Altmann – The Terrier

The plot thickens around the departure of the Lyndoch Living CEO, Doreen Power, with speculation that Ms Power’s sudden exit up the Princes Highway is linked to financial issues surrounding Lyndoch that are now under investigation.

I’ve spent the past nine days digging into exactly why the axe fell so quickly on the CEO last Thursday week (Aug 4) after years of allegations about Ms Power’s management style fell on deaf ears and the Lyndoch board continued to back her to the hilt.

As was reported here, Ms Power was confronted by board chair Sue Cassidy and treasurer Kane Grant and, soon after, left her office armed with two bags of belongings.

As was also reported here, the day before Ms Power left, WorkSafe had received a long list of complaints about Lyndoch lodged by a law firm on behalf of the complainants.

This could have been the final blow.

But no.

I have since learned there is mounting concern about Lyndoch’s financial position, including whether information relied upon to build Lyndoch’s financial picture has been accurate.

These concerns include:

the financial impact of changes to the payment system for home care packages, with Lyndoch no longer having access to a big pot of home care funds ($2.5 million as of March 2021) that sat in its bank account;

whether this big pot of funds for home care packages was used to pay for other services – say, for example, toward the new medical clinic – in the hope it could be later topped up by home care clients (a Ponzi-style approach);

the financial impact of much greater competition in home care packages, which has gouged Lyndoch’s home client list;

the financial impact of having between 50 and 55 empty beds across Lyndoch and May Noonan Hostel – unprecedented;

concerns about the impact of rising interest rates on the $12 million borrowed by Lyndoch to fund its new $22m medical clinic;

concerns about the financial impact of having five apartments for sale in the Waterfront Living complex;

the difficulty of selling these apartments amid concerns about the deteriorating condition of their exteriors;

concerns Lyndoch must legally pay out the owners and/or estate of these apartments after a certain time, regardless of whether the apartment has sold;

concerns raised by residents within Waterfront Living about the location and use of their annual maintenance fee/sinking fund.

That’s a lot to take in, but it all comes down to cash flow: what Lyndoch expected to bring in, what it has to pay out.

And the terrible possibility facing the Lyndoch board is that all is not what it seemed.

Two important things to say here:

First is that residential accommodation bonds are guaranteed by the Federal Government, so – regardless of where this ends – these are protected by law and residents and their families can take comfort they are not at risk of losing their money.

Second is that the resignation of the most recent Chief Financial Officer was clearly yet another warning bell.

In fact four Chief Financial Officers leaving in four years is not just a warning bell, but a big loud hooter that wakes everyone in the night.

If what I am being told now is correct, and I believe it is, then what we have always feared is coming to pass.

We tried to warn the board and they didn’t listen.

Collectively, this house-of-cards scenario was raised more than 18 months ago on this page, by the Terrier, then by former Chief Financial officer Allan Conway, and then by the Keep Lyndoch Living group which formed because of unanswered questions over Lyndoch’s finances.

Mr Conway set the alarm bells off, but nobody listened.

The Keep Lyndoch Living team led by Jim Burke and Prof James Dunbar tried to raise the alarm, but nobody listened.

And The Terrier – 162 stories later – tried to raise the alarm, and nobody with the power to act, listened.

But the board is listening now and so it must, because they are responsible for not asking the hard questions.

It is now incumbent upon the board chair Sue Cassidy and treasurer Kane Grant to step up and tell us what is going on.

They need to assure the community that all is well, that none of what I have raised here is correct, that Lyndoch’s finances are exactly as they should be, and that Ms Power is on annual leave because she decided to take a holiday to Port Douglas.

Now is the time for plain speaking, not bullshite about annual leave.

Now is the time for absolute, rock solid, honest truth.

Posted February 10th 2015…..”Ms Power comes to Lyndoch Living with a wealth of experience in the health sector. She is a proven chief executive”.

https://www.agedcareguide.com.au/talking-aged-care/lyndoch-living-welcomes-new-ceo

Published on April 9, 2019……”Ms Power was recognised with the prestigious national award at the 2019 Australian Healthcare Week Excellence Awards in Sydney last week.”

https://www.theweeklysource.com.au/lyndoch-livings-doreen-power-named-aged-care-ceo-of-the-year/

Words cant express just how sickening this is, but I guess its only just now becoming apparent to the incompetent board what many others could see from the outset of the ambitious “$100 million grand vision”.

Beverley Mcarthur MP… Question Asked: 28 October 2021

https://parliament.vic.gov.au/publications/questions-database/details/53/11637