Carol Altmann – The Terrier

How to save $700,000 in seven days, instalment #3:

Take a good, close look at the photograph at the top of this page, because you – if you are a Warrnambool City Council ratepayer – ultimately paid for this hospitality.

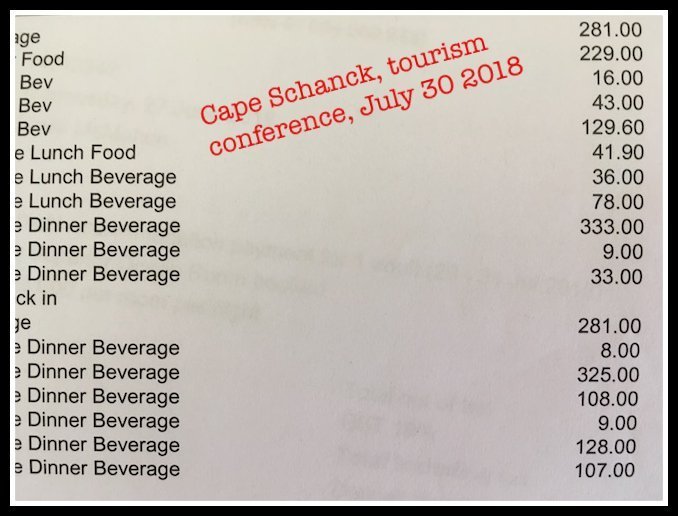

It is a snapshot of one invoice from a council delegation to a Victorian tourism conference held at the RACV Cape Schanck resort last July, which I wrote about last month.

Seven council representatives attended that two-day conference, at a total cost of around $10,000.

My first thought when I saw this snapshot was how do you spend several hundred dollars on beverages in one sitting unless you are buying drinks for a lot of people, which may be the case, or drinking gallons of soft drink or juice, which I doubt, or buying expensive drinks in the first place?

Regardless of the answer, it is your rates at work.

This sort of spending came just months before the council announced it wanted your opinion on whether it should cut services or raise rates by breaking the rate cap just three years after it was applied by the State Government.

I am still working on a much deeper investigation into council credit card usage, which I started last September, and it will be some time yet before I can publish anything in detail.

In the meantime, however, I can tell you how many corporate credit cards the council has in use: 81.

81.

I don’t know about you, but I was stunned to learn that there are 81 active credit cards in use among council staff. It seems a lot.

No cards are issued to the Mayor or councillors.

How on earth does the council keep track of all the transactions on 81 credit cards? Who has one and what are the annual spending limits for each?

Let me take those questions separately.

There is a system in place to prevent outright fraud – more on that in a minute – but I wondered about the items being bought in the first place.

Who approves the initial spending, such as the hundreds of dollars of drinks toted up over dinners at Cape Schanck?

Is there more of that sort of spending and for what purpose? (I lodged a Freedom of Information application in October to help answer these questions. It is still being processed – FOI can be gruelling, but thanks to those who donated to The Terrier Tip Jar, I can see it through.)

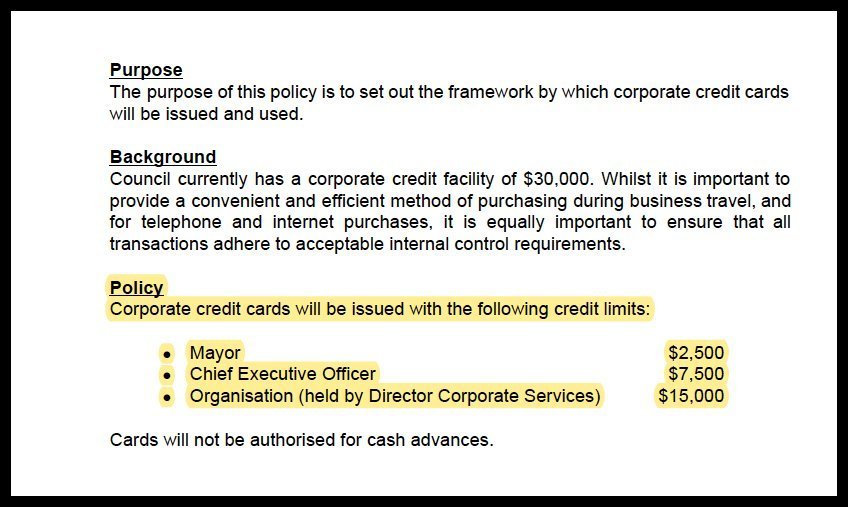

The council doesn’t have a credit card policy, but it does have a procurement policy which sets out how financial transactions are handled.

According to the council (you can read the full statement in response to my initial questions here), this policy ensures there are a series of checks and balances in place.

These include the staff member providing a tax invoice or a statutory declaration for each credit card purchase.

These are approved by a manager/supervisor, after which it is sent further up the chain to the card administrator, in the council’s Financial Services team, who makes sure it fits within the rules.

The system, which apparently saves time compared to the purchase order/invoice system which is still used for other goods, has been reviewed by the Audit and Risk Committee and, the council says, found to be working just fine.

But is it? I am hoping to answer that more fully down the track.

The second half of this investigation is working out which staff positions have corporate credit cards and what the credit limits are for each.

I thought this was a super simple question, especially when Northern Grampians Shire, for example, puts this information on its website for all to see.

But no.

Council spokesman Nick Higgins said today that the release of such information could lead to credit card fraud (such as that outlined in the link here).

I fail to see how you knowing that I have a $5000 limit on my credit card could lead to fraud, especially if you don’t have my card number, expiry, CCV, pin, signature or any other details.

Corporate credit card usage and expenditure isn’t included in the council’s survey on its push to break the rate cap above 2.5%: it should be.

More tomorrow.

If you would like to see The Terrier keep digging up, sniffing out and chewing on local issues, please make a small contribution below.

I would have thought that staff attendng work related events would be given a “meal allowance” and that the amount would have been set out in the policy/procedures document. In my organization if I spend beyond that amount, I have to pay the difference.